|

A Message From Our

| |

| EXECUTIVE CHAIRMAN

|

Fellow Shareholders:

At Leggett & Platt, we enhance people’s lives worldwide by designing and manufacturing innovative, distinctive products and components for use in bedding, furniture, homes, offices, airplanes, and automobiles.

Leggett & Platt achieved several milestones in 2021, including attaining record EPS and sales from continuing operations, increasing our dividend for the 50th consecutive year, and issuing our inaugural sustainability report. These achievements would not be possible without our 20,000 employees, who are dedicated to creating innovative, sustainable products for our customers, ensuring a safe and inclusive workplace, and driving value for our shareholders.

2022 began with the seamless, long-planned CEO transition to Mitch Dolloff, who has successfully led various of our operations over the past two decades, including our global Automotive business and more recently, our global Bedding business while serving as Leggett’s COO. We also recently promoted long-tenured employees to key leadership positions and filled several newly created positions to bolster our human capital management, as well as our ID&E and ESG efforts.

Our 2022 Annual Meeting of Shareholders will be held in a virtual format only via a live webcast starting at 10:00 AM Central Time on Tuesday, May 17, 2022 to address the agenda described in this Notice of Annual Meeting of Shareholders and Proxy Statement. Details regarding registration and attending the virtual meeting can be found at register.proxypush.com/LEG.

Your vote is very important — please vote as soon as possible, either online at www.proxypush.com/LEG or by returning the enclosed proxy or voting instruction card.

On behalf of the Board of Directors, I thank you for your participation and investment in Leggett.

Sincerely,

LEGGETT & PLATT, INCORPORATED

Karl Glassman

Executive Chairman

Notice of 2022 Annual Meeting of Shareholders

Virtual Meeting Only – No Physical Meeting Location

Tuesday, May 17, 2022 | 10:00 a.m. Central Time

Dear Shareholders:

The annual meeting of shareholders of Leggett & Platt, Incorporated (the “Company”) will be held on Tuesday, May 17, 2022, at 10:00 a.m. Central Time in a virtual meeting format only, via a live webcast, with no physical in-person meeting.

You will be able to attend and participate in the annual meeting online by registering in advance at register.proxypush.com/LEG no later than 5:00 p.m. Central Time on May 16, 2022. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and to submit questions during the meeting. The virtual annual meeting has been designed to provide substantially the same rights to participate as you would have at an in-person meeting.

The annual meeting is being held for the following purposes:

| 1. | To elect twelve directors; |

| 2. | To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022; |

| 3. | To provide an advisory vote to approve Named Executive Officer compensation; and |

| 4. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

You are entitled to vote only if you were a Leggett & Platt shareholder at the close of business on March 8, 2022.

An Annual Report to Shareholders outlining the Company’s operations during 2021 accompanies this Notice of Annual Meeting and Proxy Statement.

By Order of the Board of Directors,

Scott S. Douglas

Secretary

Carthage, Missouri

March 31, 2022

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to Be Held on May 17, 2022

The enclosed proxy materials and access to the proxy voting site are also available to you on the Internet.

You are encouraged to review all of the information contained in the proxy materials before voting.

The Company’s Proxy Statement and Annual Report to Shareholders are available at:

www.leggett.com/proxymaterials

The Company’s proxy voting site can be found at:

| PROXY STATEMENT SUMMARY | 1 | |||

| CORPORATE GOVERNANCE AND BOARD MATTERS | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING | ||||

| 12 | ||||

| PROPOSAL TWO: Ratification of Independent Registered Public Accounting Firm |

19 | |||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| PROPOSAL THREE: Advisory Vote to Approve Named Executive Officer Compensation |

22 | |||

| EXECUTIVE COMPENSATION AND RELATED MATTERS | ||||

| 23 | ||||

| 36 | ||||

| 37 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 47 | ||||

| SECURITY OWNERSHIP | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| EQUITY COMPENSATION PLAN INFORMATION | 50 | |||

| Q&A – PROXY MATERIALS AND ANNUAL MEETING | 51 | |||

This summary highlights information contained elsewhere in this proxy statement. It does not contain all the information that you should consider—please read the entire proxy statement before voting. These materials were first sent to our shareholders on March 31, 2022. Our principal executive offices are located at 1 Leggett Road, Carthage, Missouri 64836.

2022 Annual Meeting of Shareholders

|

Tuesday, May 17, 2022 10:00 a.m. Central Time

Virtual Meeting Only – advance registration required to attend. Visit register.proxypush.com/LEG

Record Date: March 8, 2022

|

|

Proposal

|

Recommendation

|

Page

| ||||

| 1 – Election of Twelve Directors |

FOR | 12 | ||||||

| 2 – Ratification of PWC

as |

FOR | 19 | ||||||

| 3 – Advisory Vote to Approve

Named |

FOR |

22 |

Business Highlights

In 2021, sales increased 19% versus 2020 to $5.073 billion. The increase was primarily due to raw material-related price increases, volume gains and currency benefit. When compared to our pre-pandemic results of 2019, trade sales were up 7%.

We also achieved record Earnings Per Share (EPS) of $2.94 in 2021. Our 2021 Earnings Before Interest and Taxes (EBIT) was $596 million for 2021, an increase of $188 million from 2020. In 2021, we generated cash from operations of $271 million versus a very strong $603 million in 2020, with the decrease primarily driven by inflationary impacts and planned working capital investments to rebuild inventory levels in several businesses following severe depletion in 2020. For detailed results, see the Company’s Annual Report on Form 10-K filed February 22, 2022.

We raised our dividend for the 50th consecutive year in 2021, reaching an indicated annual dividend of $1.68 per share with a 4.1% yield based on our year-end closing share price of $41.16.

We are pleased to have delivered these results in 2021 despite a myriad of macro market challenges, including supply chain issues related to semiconductor shortages, foam chemical shortages, labor availability, and transportation challenges, as well as higher costs associated with each of these issues.

|

1 |

Board Nominees

All of Leggett’s directors are elected for a one-year term by a majority of shares present and entitled to vote at the 2022 Annual Meeting of Shareholders (the “Annual Meeting”). The 2022 director nominees are:

|

Angela Barbee Independent

Former SVP — Technology and Global R&D Weber Inc.

|

Mark A. Blinn Independent

Retired President & CEO Flowserve Corporation

|

Robert E. Brunner Independent

Retired Executive VP Illinois Tool Works

|

Mary Campbell Independent

President — Streaming and Digital Ventures, Qurate Retail, Inc.

|

J. Mitchell Dolloff

President & CEO Leggett & Platt, Incorporated

|

Manuel A. Fernandez Independent

Managing Director SI Ventures

|

|||||||||||||

|

Karl G. Glassman

Executive Chairman Leggett & Platt, Incorporated

|

Joseph W. McClanathan Independent

Retired President & CEO — Household Products Division Energizer Holdings, Inc. |

Judy C. Odom Independent Lead Director

Retired Chair & CEO Software Spectrum, Inc. |

Srikanth Padmanabhan Independent

Vice President and President – Engine Business Segment Cummins, Inc.

|

Jai Shah Independent

Group President Masco Corporation

|

Phoebe A. Wood Independent

Retired Vice Chair & CFO Brown-Forman Corp. |

|||||||||||||

|

|

Angela Barbee |

Mark Blinn |

Robert Brunner |

Mary Campbell |

Mitchell Dolloff |

Manuel Fernandez |

Karl Glassman |

Joseph McClanathan |

Judy Odom |

Srikanth Padmanabhan |

Jai Shah |

Phoebe Wood | ||||||||||||

| Independent Director |

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| L&P Director since |

2022 | 2019 | 2009 | 2019 | 2020 | 2014 | 2002 | 2005 | 2002 | 2018 | 2019 | 2005 | ||||||||||||

| Age |

56 | 60 | 64 | 54 | 56 | 75 | 63 | 69 | 69 | 57 | 55 | 68 | ||||||||||||

| L&P Board Committees |

||||||||||||||||||||||||

| Audit |

|

|

|

|

|

Chair | ||||||||||||||||||

| Human Resources and Compensation |

|

|

Chair |

|

|

|

|

|||||||||||||||||

| Nominating, Governance and Sustainability |

|

|

Chair |

|

|

| ||||||||||||||||||

| Other Public Company Boards |

0 | 3 | 2 | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 3 | ||||||||||||

| EXPERIENCE AND QUALIFICATIONS |

|

|

|

|

|

|

|

| ||||||||||||||||

| Financial/Accounting |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Global Business |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| R&D/Innovation/Tech |

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Manufacturing/Operations |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Governance/Sustainability |

|

|

|

|

|

|

|

|

| |||||||||||||||

| Strategic Planning |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| HR/Compensation |

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Risk Management |

|

|

|

|

| |||||||||||||||||||

| IT/Cybersecurity |

|

|

|

|

|

|

| |||||||||||||||||

| L&P Industry Experience |

|

|

|

|

|

|

||||||||||||||||||

| Gender/Ethnic Diversity |

|

|

|

|

|

|

| |||||||||||||||||

Diversity – Our Nominating, Governance and Sustainability Committee recognizes the value of cultivating a Board with a diverse mix of opinions, perspectives, skills, experiences, and backgrounds. A diverse board enables more balanced, wide-ranging discussion in the boardroom, which, we believe, enhances the decision-making processes. The matrix above reflects some aspects of the Board’s diversity. In addition, seven of our ten independent director nominees (70%) are diverse, with four women and four nominees who self-identify as racial or ethnic minorities.

|

2 |

2022 Proxy Statement |

Executive Compensation

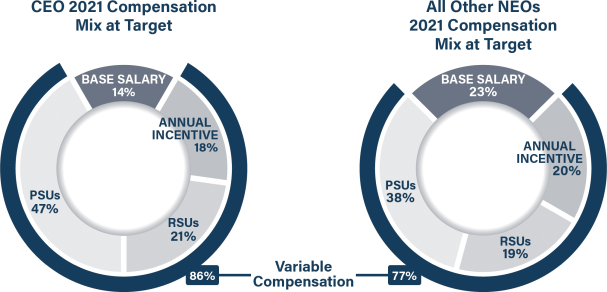

L&P seeks to align our executives’ and shareholders’ interests through pay-for-performance. In 2021, 86% of our CEO’s target pay was allocated to variable compensation and 68% was delivered in equity-based awards.

Our compensation structure strives to strike an appropriate balance between short-term and longer-term compensation that reflects the short- and longer-term interests of the business. We believe this structure helps us attract, retain and motivate high-performing executives who will achieve outstanding results for our shareholders.

Key Components of Our Executive Officers’ 2021 Compensation Program

| Base Salary: Our executives’ salaries reflect their responsibilities, performance and experience while taking into account market data, peer benchmarking and internal equity.

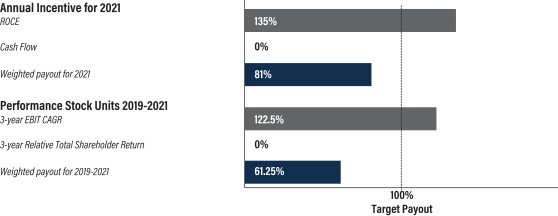

Annual Incentive: Short-term cash incentive with payouts ranging from 0% to 150% based on Return on Capital Employed (ROCE) and cash flow targets based on the Company’s earning guidance for the year.

Long-Term Incentive – 2/3 allocated to PSUs: Three-year PSUs with payouts ranging from 0% to 200% based on (1) relative TSR measured against the industrial, materials and consumer discretionary sectors of the S&P 500 and S&P MidCap 400 and (2) the Company’s EBIT CAGR.

Long-Term Incentive – 1/3 allocated to RSUs: The RSUs vest in 1/3 increments on the first, second and third anniversaries of the grant date, further tying our executives’ pay to the Company’s performance. |

|

CEO Transition and 2022 Compensation

On January 1, 2022, Mitch Dolloff became the Company’s Chief Executive Officer, after serving as Leggett’s Chief Operating Officer since 2019 and in various other capacities since 2000. In connection with Mr. Dolloff’s appointment as CEO, the Board of Directors increased his 2022 base salary to $1,120,000 and set his target annual incentive percentage at 125% of base salary and his long-term incentive percentage at 400% (allocated between PSUs and RSUs as described above). At these target levels, 84% of Mr. Dolloff’s 2022 pay package is variable and 64% is equity-based. Mr. Dolloff also received a one-time promotional award of three-year RSUs valued at $1,000,000.

At the same time, our former CEO, Karl Glassman, transitioned to the role of Executive Chairman. In this role, Mr. Glassman’s 2022 compensation package was set at $750,000 base salary, 100% target annual incentive, and 200% long-term incentive (granted solely in RSUs).

|

3 |

Key Features of Our Executive Officer Compensation Program

| What We Do | What We Don’t Do | |||||||||||||||

|

✓ Pay for Performance – A significant majority of our Named Executive Officers’ (NEOs) compensation is at-risk variable compensation.

✓ Multiple Performance Metrics – Variable compensation is based on more than one measure to encourage balanced incentives.

✓ Incentive Award Caps – All of our variable compensation plans have maximum payout limits.

✓ Benchmarking – We compare our compensation package to market surveys and a customized peer group, and the Committee engages an independent consultant.

✓ Stock Ownership Requirements – All NEOs are subject to robust stock ownership requirements.

✓ Confidentiality & Non-Compete Agreements – All NEOs are subject to confidentiality and non-compete agreements.

✓ Clawbacks – Our policies exceed the mandates of Sarbanes-Oxley.

|

× No Single-Trigger Change in Control – Our CIC-related cash severance and equity awards (other than legacy stock options) have a double trigger.

× No Hedging or Pledging – We do not permit our executive officers to engage in either hedging or pledging activities with respect to Leggett shares.

× No Excessive Perquisites – Perquisites represent less than 1% of our NEOs’ compensation.

× No Employment Agreements – All of our NEOs are employed at-will.

× No Repricing of Options or Cash Buyouts

× No Share Recycling

× No Dividends on Equity Awards Prior to Vesting

× No Tax Gross-Ups |

|||||||||||||||

Board Oversight of ESG and Related Matters

Following the self-evaluations at the end of 2020, the Board of Directors and its Committees reviewed the oversight structure for certain environmental, social and governance (ESG) matters. As a result, the renamed Nominating, Governance and Sustainability Committee amended its charter responsibilities to oversee the Company’s corporate responsibility and sustainability policies and programs, including environmental and climate change, social and governance matters, reviewing the Company’s sustainability report and any sustainability targets, and annually reviewing the Company’s political and charitable contributions. In addition, the renamed Human Resources and Compensation Committee amended its charter responsibilities to include overseeing the Company’s human resources policies and programs, executive succession planning, and senior management leadership development.

Although the Board has delegated direct oversight of certain ESG matters to its committees, the Board has retained primary oversight responsibility of the Company’s cybersecurity programs and its inclusion, diversity and equity (ID&E) efforts.

|

4 |

2022 Proxy Statement |

Corporate Governance and Board Matters

Leggett & Platt has a long-standing commitment to sound corporate governance principles and practices. The Board of Directors has adopted Corporate Governance Guidelines that establish the roles and responsibilities of the Board and management. The Board has also adopted a Code of Business Conduct and Ethics applicable to all Company employees, officers and directors, as well as a separate Financial Code of Ethics applicable to the Company’s CEO, CFO, and Chief Accounting Officer. These documents can be found at www.leggett.com/governance. Information on our website does not constitute part of this proxy statement.

Director Independence and Board Service

The Board reviews director independence annually and during the year upon learning of any change in circumstances that may affect a director’s independence. The Company has adopted director independence standards (the “Independence Standards”) that satisfy the NYSE listing requirements and can be found at www.leggett.com/governance. A director who meets all the Independence Standards will be presumed to be independent.

While the Independence Standards help the Board to determine director independence, they are not the only criteria. The Board also reviews the relevant facts and circumstances of any material relationships between the Company and its directors during the independence assessment. Based on its review, the Board has determined that all current non-management directors are independent. The director biographies accompanying Proposal One: Election of Directors identify our independent and management directors on the ballot.

All non-management directors meet the additional independence standards for audit committee service

under NYSE and SEC rules and are financially literate, as defined by NYSE rules. In addition, Audit Committee members Mark Blinn, Robert Brunner, Srikanth Padmanabhan, Jai Shah, and Phoebe Wood meet the SEC’s definition of an “audit committee financial expert.” No member serves on the audit committee of more than three public companies.

All non-management directors satisfy the enhanced independence standards required by the NYSE listing standards and SEC rules for service on the Human Resources and Compensation Committee.

As provided in our Corporate Governance Guidelines, non-management directors can sit on no more than five public company boards (including our own) and the CEO can sit on no more than two public company boards without Board approval. The NGS Committee conducts an annual review of director commitment levels and affirmed that all the nominees for the 2022 Annual Meeting were compliant.

Our Corporate Governance Guidelines allow the roles of Chairman of the Board and CEO to be filled by the same or different individuals. This approach allows the Board flexibility to determine whether the two roles should be separate or combined based upon the Company’s needs and the Board’s assessment of the Company’s leadership from time to time.

The Board has elected former CEO Karl Glassman as the Executive Chairman effective January 1, 2022. Judy Odom has served as independent Lead Director since 2020. With Mitch Dolloff having succeeded Mr. Glassman as Chief Executive Officer on January 1, 2022, the Board believes this leadership structure best serves the Board, the Company and our shareholders.

The Lead Director’s responsibilities include:

| • | Serving as the liaison between the independent directors and the CEO and Chairman. |

| • | Acting as the principal representative of the independent directors in communicating with shareholders. |

| • | Working with the Chairman and CEO to set the schedule and agenda for Board meetings, and overseeing delivery of materials to the directors. |

| • | Calling special executive sessions of the independent directors upon notice to the full Board. |

| • | Presiding over meetings of the non-management directors and over Board meetings in the Chairman’s absence. |

Our non-management directors regularly hold executive sessions without management present. At least one executive session per year is attended by only independent, non-management directors, and such an executive session was held at each quarterly Board meeting in 2021.

|

5 |

Corporate Governance and Board Matters

Shareholders and all other interested parties who wish to contact our Board of Directors may e-mail our Lead Director, Ms. Odom, at leaddirector@leggett.com. They can also write to Leggett & Platt Lead Director, P.O. Box 637, Carthage, MO 64836. The Corporate Secretary’s office reviews this correspondence and periodically provides the Lead Director all communications except items unrelated to Board functions. The Lead Director may forward communications to the full Board or to any of the other independent directors for further consideration.

Board and Committee Composition and Meetings

Leggett’s Board of Directors held six meetings in 2021, and its committees met the number of times listed in the table below. All directors attended at least 75% of the Board meetings and their respective committee meetings. Directors are expected to attend the Company’s Annual Meeting, and all of them attended the 2021 Annual Meeting.

The Board has a standing Audit Committee, Human Resources and Compensation (HRC) Committee, and Nominating, Governance and Sustainability (NGS) Committee. These committees consist entirely of independent directors, and each operates under a written charter adopted by the Board. The Audit, HRC, and NGS Committee charters are posted on our website at www.leggett.com/governance.

|

Audit Committee Phoebe A. Wood (Chair) Mark A. Blinn Robert E. Brunner Mary Campbell Srikanth Padmanabhan Jai Shah

Meetings in 2021: 5 |

The Audit Committee assists the Board in the oversight of: • Independent registered public accounting firm’s qualifications, independence, appointment, compensation, retention and performance. • Internal control over financial reporting. • Guidelines and policies to govern risk assessment and management. • Performance of the Company’s internal audit function. • Integrity of the financial statements and external financial reporting. • Legal and regulatory compliance. • Complaints and investigations of any questionable accounting, internal control or auditing matters.

| |

|

Human Resources and Compensation Committee Robert E. Brunner (Chair) Angela Barbee Mark A. Blinn Manuel A. Fernandez Joseph W. McClanathan Judy C. Odom Jai Shah

Meetings in 2021: 5

|

The HRC Committee assists the Board in the oversight and administration of: • The Company’s human resources policies and programs. • CEO, executive officer, and director compensation. • Incentive compensation and equity-based plans. • Executive succession planning. • Senior management leadership development. • Employment agreements, change-in-control agreements, and severance benefit agreements with the CEO and executive officers, as applicable. • Related person transactions of a compensatory nature. | |

|

Nominating, Governance and Sustainability Committee Joseph W. McClanathan (Chair) Mary Campbell Manuel A. Fernandez Judy C. Odom Srikanth Padmanabhan Phoebe A. Wood

Meetings in 2021: 5

|

The NGS Committee assists the Board in the oversight of: • Corporate governance principles, policies and procedures. • Identifying qualified candidates for Board membership and recommending director nominees. • Recommending committee members and Board leadership positions. • The Company’s policies and programs relating to corporate responsibility and sustainability, including environmental, social and governance matters. • The Company’s political and charitable contributions. • Director independence and related person transactions. |

|

6 |

2022 Proxy Statement |

Corporate Governance and Board Matters

Board and Committee Evaluations

The Board and each of its Committees conduct an annual self-evaluation of their practices and charter responsibilities. In addition, the Board periodically retains an outside consultant to assist in the evaluations, solicits survey responses from individual directors on Board and Committee effectiveness, and conducts director peer reviews of the qualifications and contributions of its individual members. In 2021, following the prior year’s evaluations, the Board and Committees further delineated responsibilities for various environmental, social and governance (ESG) matters, expanded committee oversight of human resources, and updated the committee charters.

Board’s Oversight of Risk Management

The Company’s CEO and other senior managers are responsible for assessing and managing various risk exposures on a day-to-day basis. Our Enterprise Risk Management Committee (the “ERM Committee”), comprised of a broad group of executives and chaired by our CFO, adopted guidelines by which the Company identifies, assesses, monitors and reports financial and non-financial risks material to the Company.

The ERM Committee meets at least quarterly. Identified risks, including emerging risks, are assigned to a team of subject matter experts who meet regularly throughout the year and provide an updated assessment report to the ERM Committee twice each year (or as circumstances require) for their respective risk areas. On a semi-annual basis, these reports are compiled into a risk summary report which is further reviewed and discussed with the ERM Committee to determine if any actions need to be taken. A summary is provided to senior management and the Board concerning (i) the likelihood, significance, and impact velocity of each risk, (ii) management’s actions to monitor and control risks, and (iii) identified emerging risks. The Audit Committee performs an annual review of the guidelines and policies that govern the process by which risk assessment and management is undertaken, as well as reviews and discusses major financial risks on a semi-annual basis. In addition, a designated Board member receives a copy of all reports received through the Company’s ethics hotline.

The Company has formal processes in place for both incident response and cybersecurity continuous improvement that include a cross functional Cybersecurity Oversight Committee. The Chief Information Officer (a member of the Cybersecurity Oversight Committee) updates the Board quarterly on cyber activity, with procedures in place for interim reporting as necessary.

During 2020, a COVID-19 Response Team was established to direct health and safety activities related to the pandemic. The Team, led by senior management, developed company-wide policies and established safety procedures in response to specific COVID-19

related risks. Key activities that have continued since being instituted in 2020 include protocols for (i) safety and social distancing, (ii) communication, training, and visual management, (iii) re-layout of manufacturing and internal logistics, and (iv) governance and compliance. A multi-layered COVID-19 Response Network was established to deliver training and communication to our employees at all levels of the organization, as well as obtaining employee feedback, sharing best practices, and identifying improvement opportunities. COVID-19 Response activities are reviewed with the Board on a quarterly basis, with interim updates as appropriate.

The HRC Committee’s oversight of executive officer compensation, including the assessment of compensation risk for executive officers, is detailed in the Compensation Discussion & Analysis section on page 23. The Committee also assesses our compensation structure for employees generally and has concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. The following factors contributed to this determination:

| • | We use a combination of short-term and long-term incentive rewards that are tied to varied and complementary measures of performance and have overlapping performance periods. |

| • | We use common annual incentive plans across all business units. |

| • | Our annual incentive plan and our omnibus equity plan contain clawback provisions that enable the Committee to recoup incentive payments, when triggered. |

| • | Our employees below key management levels have a small percentage of their total pay in variable compensation. |

| • | We promote an employee ownership culture to better align employees with shareholders, with approximately 3,000 employees contributing their own funds to purchase Company stock under various stock purchase plans in 2021. |

|

7 |

Corporate Governance and Board Matters

Consideration of Director Nominees and Diversity

The Nominating, Governance and Sustainability (NGS) Committee is responsible for identifying and evaluating the best available qualified candidates for election to the Board of Directors. The Committee’s procedure and the Company’s bylaws can be found at www.leggett.com/governance. Following its evaluation, the NGS Committee recommends to the full Board a slate of director candidates for inclusion in the Company’s proxy statement and proxy card.

Incumbent Directors. In the case of incumbent directors, the NGS Committee reviews each director’s overall service during his or her current term, including the number of meetings attended, level of participation, quality of performance and any transactions between the director and the Company.

New Director Candidates. In the case of new director candidates, the NGS Committee first determines whether the nominee will be independent under NYSE rules, then identifies any special needs of the Board. The NGS Committee will consider individuals recommended by Board members, Company management, shareholders and, if it deems appropriate, a professional search firm. In 2022, the Company retained a search firm, Diversified Search, to assist with identifying and evaluating potential director candidates, including Ms. Barbee.

The NGS Committee believes director candidates should meet and demonstrate the following criteria:

| • | Character and integrity. |

| • | A commitment to the long-term growth and profitability of the Company. |

| • | A willingness and ability to make a sufficient time commitment to the affairs of the Company to effectively perform the duties of a director, including regular attendance at Board and committee meetings. |

| • | Significant business or public experience relevant and beneficial to the Board and the Company. |

Board Diversity. The NGS Committee recognizes the value of cultivating a Board with a diverse mix of opinions, perspectives, skills, experiences, and backgrounds. A diverse board enables more balanced, wide-ranging discussion in the boardroom, which, we believe, enhances the decision-making processes. Having diverse representation and a variety of viewpoints is also important to our shareholders and other stakeholders.

As such, the NGS Committee actively seeks director candidates from a wide variety of backgrounds, without discrimination based on race, ethnicity, color, ancestry, national origin, religion, sex, sexual orientation, gender identity, age, disability, or any other status protected by law. In furtherance of this non-discrimination policy, for each search, the Committee will ensure that the pool includes female and racial or ethnic minority candidates.

All nominations to the Board will be based upon merit, experience and background relevant to the Board’s current and anticipated needs, as well as Leggett’s businesses.

Director Recommendations from Shareholders. The NGS Committee does not intend to alter its evaluation process, including the minimum criteria set forth above, for candidates recommended by a shareholder. Shareholders who wish to recommend candidates for the NGS Committee’s consideration must submit a written recommendation to the Secretary of the Company at 1 Leggett Road, Carthage, MO 64836. Recommendations must be sent by certified or registered mail and received by December 15th for the NGS Committee’s consideration for the following year’s Annual Meeting. Recommendations must include the following:

| • | Shareholder’s name, number of shares owned, length of period held and proof of ownership. |

| • | Candidate’s name, address, phone number and age. |

| • | A resume describing, at a minimum, the candidate’s educational background, occupation, employment history and material outside commitments (memberships on other boards and committees, charitable foundations, etc.). |

| • | A supporting statement which describes the shareholder’s and candidate’s reasons for nomination to the Board of Directors and documents the candidate’s ability to satisfy the director qualifications described above. |

| • | The candidate’s consent to a background investigation and to stand for election if nominated by the Board and to serve if elected by the shareholders. |

| • | Any other information that will assist the NGS Committee in evaluating the candidate in accordance with this procedure. |

|

8 |

2022 Proxy Statement |

Corporate Governance and Board Matters

Director Nominations for Inclusion in Leggett’s Proxy Materials (Proxy Access). The Board has approved a proxy access bylaw, which permits a shareholder, or group of up to 20 shareholders, owning at least 3% of our outstanding shares continuously for at least three years, to nominate and include in Leggett’s proxy materials up to the greater of two nominees or 20% of the Board, provided the shareholders and nominees satisfy the requirements specified in our bylaws. Notice of proxy access nominees for the 2023 Annual Meeting must be received no earlier than January 17, 2023 and no later than February 16, 2023.

Notice of Other Director Nominees. For shareholders intending to nominate a director candidate for election at the 2023 Annual Meeting outside of the Company’s nomination process, our bylaws require that the Company receive notice of the nomination no earlier than January 17, 2023 and no later than February 16, 2023. This notice must provide the information specified in Section 2.2 of the bylaws.

Transactions with Related Persons

According to our Corporate Governance Guidelines, the NGS Committee reviews transactions in which a related person has a direct or indirect material interest, the Company or a subsidiary is a participant, and the amount involved exceeds $120,000. If the transaction with a related person concerns compensation, the HRC Committee conducts the review.

The Company’s executive officers and directors are expected to notify the Company’s Corporate Secretary of any current or proposed transaction that may be a related person transaction. The Corporate Secretary will determine if it is a related person transaction and, if so, will include it for consideration at the next meeting of the appropriate Committee. The appropriate Committee will conduct a reasonable prior review and oversight of any related person transaction for potential conflicts of interest and will prohibit any such transaction if the Committee determines it to be inconsistent with the interests of the Company and its shareholders. If it becomes necessary to review a related person transaction between meetings, the Chair of the appropriate Committee is authorized to act on behalf of the Committee. The Chair will provide a report on the matter to the full Committee at its next meeting.

The full policy for reviewing transactions with related persons, including categories of pre-approved transactions, is found in our Corporate Governance Guidelines available on our website at www.leggett.com/governance.

The Company employs certain relatives of its executive officers, but only two had total compensation (consisting of salary and annual incentive earned in 2021, as well as the grant date fair value of equity awards issued in 2021) in excess of the $120,000 related person transaction threshold: Rebecca Burns, Staff VP—Record to Report Business Processes, the spouse of Ben Burns, Senior VP—Business Support Services, had 2021 total compensation of $175,389; and Ashley Hiatt, Staff VP—Segment Reporting, the sister-in-law of Mr. Burns, had total 2021 compensation of $152,681.

|

9 |

Corporate Governance and Board Matters

Our non-management directors receive an annual retainer, consisting of a mix of cash and equity, as set forth in the table below. Our management directors (Mr. Glassman and Mr. Dolloff) do not receive additional compensation for their Board service.

| Cash Compensation |

||||

| Director Retainer |

$ |

90,000 |

| |

| Audit Committee Retainer |

||||

| Chair |

|

25,000 |

| |

| Member |

|

10,000 |

| |

| HRC Committee Retainer |

||||

| Chair |

|

20,000 |

| |

| Member |

|

8,000 |

| |

| NGS Committee Retainer |

||||

| Chair |

|

15,000 |

| |

| Member |

|

7,000 |

| |

| Equity Compensation – Restricted Stock or RSUs |

||||

| Director Retainer |

|

150,000 |

| |

| Lead Director Additional Retainer |

|

125,000 |

| |

The HRC Committee reviews director compensation annually and recommends any changes to the full Board for consideration at its November meeting. The Committee considers national survey data and trends, as well as peer company benchmarking data (see discussion of the executive compensation peer group at page 33) but does not target director compensation to any specific percentage of the median. The directors’ annual cash and equity retainers were not increased in 2021.

The directors’ equity awards are generally granted in connection with the May Board meeting, and a prorated award is granted to a director elected by the Board at another time of the year.

Directors may elect to receive the equity retainer in restricted stock or restricted stock units (“RSUs”). Electing RSUs enables directors to defer receipt of the shares for two to ten years while accruing dividend

equivalent shares at a 20% discount to market price over the deferral period. Both restricted stock and RSUs vest on the day prior to the next year’s Annual Meeting.

Many of our directors elected to defer a portion of their 2021 cash retainer into Leggett stock units at a 20% discount under the Company’s Deferred Compensation Program, described on page 31. Interest-bearing cash deferrals and stock options are the other alternatives under the Program.

Our non-management directors currently comply with the stock ownership guidelines requiring them to hold Leggett stock with a value of five times their annual cash retainer within five years of joining the Board.

The Company pays for all travel expenses the directors incur to attend Board meetings, although no in-person meetings were held in 2021.

|

10 |

2022 Proxy Statement |

Corporate Governance and Board Matters

Director Compensation in 2021

Our non-management directors received the following compensation in 2021. Ms. Barbee is not included in the following tables, since she first joined the Board in 2022.

| Director

|

Fees Earned or Paid in Cash(1)

|

Stock Awards(2)

|

Non-Qualified Deferred Compensation Earnings(3)

|

All Other Compensation(4)

|

Total

|

|||||||||||||||

| Mark A. Blinn |

|

$104,000 |

|

|

$150,000 |

|

|

$ 4,944 |

|

|

$258,944 |

| ||||||||

| Robert E. Brunner |

|

118,500 |

|

|

150,000 |

|

|

$15,543 |

|

|

91,797 |

|

|

375,840 |

| |||||

| Mary Campbell |

|

103,500 |

|

|

150,000 |

|

|

2,998 |

|

|

37,867 |

|

|

294,365 |

| |||||

| Manuel A. Fernandez |

|

105,000 |

|

|

150,000 |

|

|

3,553 |

|

|

14,211 |

|

|

272,764 |

| |||||

| Joseph W. McClanathan |

|

113,000 |

|

|

150,000 |

|

|

1,811 |

|

|

40,438 |

|

|

305,249 |

| |||||

| Judy C. Odom |

|

102,500 |

|

|

275,000 |

|

|

10,091 |

|

|

53,202 |

|

|

440,793 |

| |||||

| Srikanth Padmanabhan |

|

103,500 |

|

|

150,000 |

|

|

4,944 |

|

|

258,444 |

| ||||||||

| Jai Shah |

|

106,500 |

|

|

150,000 |

|

|

3,194 |

|

|

12,774 |

|

|

272,468 |

| |||||

| Phoebe A. Wood |

|

118,500 |

|

|

150,000 |

|

|

9,486 |

|

|

38,342 |

|

|

316,328 |

| |||||

| (1) | These amounts include cash compensation deferred into stock units or stock options under our Deferred Compensation Program, described at page 31. The following directors deferred cash compensation into stock units: Brunner—$118,500, Campbell—$103,500, McClanathan—$113,000, and Odom—$51,250. Mr. Shah deferred $106,500 to acquire stock options. |

| (2) | These amounts reflect the grant date fair value of the annual restricted stock or RSU awards, which was $150,000 for each director, plus an additional $125,000 retainer for Ms. Odom’s service as Lead Director. The grant date value of these awards is determined by the stock price on the day of the award. |

| (3) | These amounts include the 20% discount on stock unit dividends acquired under our Deferred Compensation Program and RSUs. |

| (4) | Items in excess of $10,000 that are reported in this column consist of (i) dividends paid on the annual restricted stock or RSU awards and dividends paid on stock units acquired under our Deferred Compensation Program: Brunner—$62,172, Campbell—$11,992, Fernandez—$14,211, McClanathan—$12,188, Odom—$40,363, Shah—$12,774, and Wood—$37,944; and (ii) the 20% discount on stock units purchased with deferred cash compensation: Brunner—$29,625, Campbell—$25,875, McClanathan—$28,250, and Odom—$12,813. |

All non-management directors held unvested stock or stock units as of December 31, 2021 as set forth below. The restricted stock and RSUs will vest on May 16, 2022.

| Director

|

Restricted Stock

|

Restricted Stock Units

|

||||||

| Mark A. Blinn |

|

2,768 |

|

|||||

| Robert E. Brunner |

|

2,830 |

| |||||

| Mary Campbell |

|

2,830 |

| |||||

| Manuel A. Fernandez |

|

2,830 |

| |||||

| Joseph W. McClanathan |

|

2,768 |

|

|||||

| Judy C. Odom |

|

5,188 |

| |||||

| Srikanth Padmanabhan |

|

2,768 |

|

|||||

| Jai Shah |

|

2,830 |

| |||||

| Phoebe A. Wood |

|

2,830 |

| |||||

Two directors held outstanding stock options as of December 31, 2021 which were granted in lieu of cash compensation under our Deferred Compensation Program: Ms. Campbell—4,274 options and Mr. Shah—12,865 options.

|

11 |

Proposals to be Voted on at the Annual Meeting

PROPOSAL ONE: Election of Directors

At the 2022 Annual Meeting, twelve directors are nominated to hold office until the 2023 Annual Meeting of Shareholders, or until their successors are elected and qualified. All nominees have been previously elected by our shareholders, except Ms. Barbee who was appointed by the Board in 2022. If any nominee named below is unable to serve as a director (an event the Board does not anticipate), proxies will be voted for a substitute nominee, if any, designated by the Board.

In recommending the slate of director nominees, our Board has chosen individuals of character and integrity, with a commitment to the long-term growth and profitability of the Company. We believe each of the nominees brings significant business or public experience relevant and beneficial to the Board and the Company, as well as a work ethic and disposition that foster the collegiality necessary for the Board and its committees to function efficiently and best represent the interests of our shareholders.

Additional information concerning the directors is found in the Proxy Summary at page 2.

|

Angela Barbee

|

||

|

Independent Director

Director Since: 2022 Age: 56

Committees: HRC |

Professional Experience:

Ms. Barbee was Senior Vice President—Technology and Global R&D of Weber Inc., a manufacturer of charcoal, gas, pellet, and electric outdoor grills and accessories, from 2021 until January 2022. She previously served as Vice President—Advance Development, Global Kitchen & Bath Group of Kohler Company, a global leader in the design, innovation and manufacture of kitchen and bath products, engines and power systems, and luxury cabinetry and tile, from 2020 to 2021, and as Vice President—New Product Development and Engineering, Global Faucets from 2018 to 2020. Ms. Barbee served as Director—Global Creative Design Operations of General Motors, a global company that designs, builds, and sells trucks, crossovers, cars, and automobile parts and accessories, from 2013 to 2017, and in various other capacities since 1994.

Education:

Ms. Barbee holds a bachelor’s degree in mechanical engineering from Wayne State University, a master’s degree in mechanical engineering from Purdue University, and has completed the Executive Education Program in the Ross Business School at the University of Michigan.

Director Qualifications:

Through her positions at Weber, Kohler and General Motors, Ms. Barbee has a wide-ranging knowledge of manufacturing, engineering and innovation, management, and operations in the consumer products and automotive industries. She also has extensive international experience in leading engineering, development and innovation efforts.

|

|

12 |

2022 Proxy Statement |

Election of Directors

|

Mark A. Blinn

|

||

|

Independent Director

Director Since: 2019 Age: 60

Committees: Audit HRC |

Professional Experience:

Mr. Blinn was President and Chief Executive Officer and a director of Flowserve Corporation, a leading provider of fluid motion and control products and services for the global infrastructure markets, from 2009 until his retirement in 2017. He previously served Flowserve as Chief Financial Officer from 2004 to 2009 and in the additional role of Head of Latin America from 2007 to 2009. Prior to Flowserve, Mr. Blinn’s positions included Chief Financial Officer of FedEx Kinko’s Office and Print Services Inc. and Vice President, Corporate Controller and Chief Accounting Officer of Centex Corporation.

Education:

Mr. Blinn holds a bachelor’s degree, a law degree, and an MBA from Southern Methodist University.

Public Company Boards:

Mr. Blinn currently serves as a director of Texas Instruments, Incorporated, a global semiconductor design and manufacturing company, Emerson Electric Co., a global technology and engineering company for industrial, commercial and residential markets, and Globe Life Inc., a financial services holding company specializing in life insurance, annuity, and supplemental health insurance products. He previously served as a director of Kraton Corporation, a leading global producer of polymers for a wide range of applications.

Director Qualifications:

As the former CEO and CFO of Flowserve, Mr. Blinn has exceptional leadership experience in operations and finance, as well as strategic planning and risk management. His board service at other global, public companies provides additional perspective on current finance, oversight, and governance matters.

|

|

Robert E. Brunner

|

||

|

Independent Director

Director Since: 2009 Age: 64

Committees: HRC, Chair Audit

|

Professional Experience:

Mr. Brunner was the Executive Vice President of Illinois Tool Works (ITW), a Fortune 250 global, multi-industrial manufacturer of advanced industrial technology, from 2006 until his retirement in 2012. He previously served ITW as President—Global Auto beginning in 2005 and President—North American Auto from 2003.

Education:

Mr. Brunner holds a degree in finance from the University of Illinois and an MBA from Baldwin-Wallace University.

Public Company Boards:

Mr. Brunner currently serves as the independent Board Chair of Lindsay Corporation, a global manufacturer of irrigation equipment and road safety products, and as a director of NN, Inc., a diversified industrial company that designs and manufactures high-precision components and assemblies on a global basis.

Director Qualifications:

Mr. Brunner’s experience and leadership with ITW, a diversified manufacturer with a global footprint, provides valuable insight to our Board on the automotive strategy, business development, mergers and acquisitions, operations, and international issues.

|

|

13 |

Election of Directors

|

Mary Campbell

|

||

|

Independent Director

Director Since: 2019 Age: 54

Committees: Audit NGS

|

Professional Experience:

Ms. Campbell was appointed President—Streaming and Digital Ventures of Qurate Retail, Inc., in 2022. Qurate Retail is comprised of a select group of retail brands including QVC, HSN, Zulily, Ballard Designs, Frontgate, Garnet Hill, and Grandin Road and is a leader in video commerce, a top-10 ecommerce retailer, and a leader in mobile and social commerce. During her more than 20 years with the company, Ms. Campbell held various leadership positions across the Merchandising, Planning and Commerce Platforms functions. Most recently, and prior to her current position, she served as Chief Content, Digital, and Platforms Officer of QxH, a segment of Qurate, since 2021, as Chief Merchandising Officer of Qurate Retail Group and Chief Commerce Officer of QVC US from 2018 to 2021, as Chief Merchandising and Interactive Officer in 2018, as Chief Interactive Experience Officer from 2017 to 2018, and as Executive Vice President, Commerce Platforms for QVC from 2014 to 2017.

Education:

Ms. Campbell holds a bachelor’s degree in psychology from Central Connecticut State University.

Director Qualifications:

Through her positions at QxH, Qurate Retail Group and QVC, Ms. Campbell has extensive knowledge in consumer driven product innovation, marketing and brand building, and traditional and new media platforms, as well as leading teams for long term growth and evolution.

|

|

J. Mitchell Dolloff

|

||

|

Management Director

Director Since: 2020 Age: 56

Committees: None

|

Professional Experience:

Mr. Dolloff was appointed the Company’s Chief Executive Officer, effective January 1, 2022, and continues to serve as President since his appointment in 2020. He previously served as Chief Operating Officer from 2019 until his appointment as CEO; President—Bedding Products from 2020 to 2021; President—Specialized Products & Furniture Products from 2017 to 2019; Senior Vice President and President of Specialized Products from 2016 to 2017; Vice President and President of the Automotive Group from 2014 to 2015; President of Automotive Asia from 2011 to 2013; Vice President of Specialized Products from 2009 to 2013; and in various other capacities for the Company since 2000.

Education:

Mr. Dolloff holds a degree in economics from Westminster College (Fulton, Missouri), as well as a law degree and an MBA from Vanderbilt University.

Director Qualifications:

As the Company’s President and CEO, Mr. Dolloff provides comprehensive insight to the Board from strategic planning to implementation at all levels of the Company around the world, as well as the Company’s relationships with investors, the financial community and other key stakeholders.

|

|

14 |

2022 Proxy Statement |

Election of Directors

|

Manuel A. Fernandez

| ||

|

Independent Director

Director Since: 2014 Age: 75

Committees: HRC NGS |

Professional Experience:

Mr. Fernandez co-founded SI Ventures, a venture capital firm focusing on IT and communications infrastructure, and has served as the managing director since 2000. Previously, he served as the Chairman, President and Chief Executive Officer at Gartner, Inc., a research and advisory company, from 1989 to 2000. Prior to Gartner, Mr. Fernandez was President and CEO of three technology-driven companies, including Dataquest, an information services company, Gavilan Computer Corporation, a laptop computer manufacturer, and Zilog Incorporated, a semiconductor manufacturer. Mr. Fernandez was the Executive Chairman of Sysco Corporation, a marketer and distributor of foodservice products, from 2012 until his retirement in 2013, having previously served as Non-executive Chairman since 2009 and as a director since 2006.

Education:

Mr. Fernandez holds a degree in electrical engineering from the University of Florida and completed post-graduate work in solid-state engineering at the University of Florida.

Public Company Boards:

Mr. Fernandez currently serves as the lead independent director of Performance Food Group Company, a foodservice products distributor. He was previously the non-executive chairman of Brunswick Corporation, a market leader in the marine industry, and a director of Time, Inc., a global media company.

Director Qualifications:

Mr. Fernandez’ venture capital experience, leadership of several technology companies as CEO and service on a number of public company boards offers Leggett outstanding insight into corporate strategy and development, information technology, international growth, and corporate governance.

| |

|

Karl G. Glassman

| ||

|

Management Director

Director Since: 2002 Chairman Since: 2020 Age: 63

Committees: None

|

Professional Experience:

Mr. Glassman was appointed Executive Chairman of the Board effective January 1, 2022, following his retirement as the Company’s Chief Executive Officer on December 31, 2021, a position he held since 2016. Mr. Glassman was first appointed Chairman of the Board in 2020. He previously served as President from 2013 to 2019, Chief Operating Officer from 2006 to 2015, Executive Vice President from 2002 to 2013, President of the former Residential Furnishings Segment from 1999 to 2006, Senior Vice President from 1999 to 2002, and in various capacities since 1982.

Education:

Mr. Glassman holds a degree in business management and finance from California State University—Long Beach.

Director Qualifications:

As the Company’s outgoing CEO with decades of experience in Leggett’s senior management team, Mr. Glassman offers exceptional knowledge of the Company’s operations, strategy and governance, as well as its customers and end markets. Mr. Glassman also serves on the Board of Directors of the National Association of Manufacturers.

| |

|

15 |

Election of Directors

|

Joseph W. McClanathan

| ||

|

Independent Director

Director Since: 2005 Age: 69

Committees: HRC NGS, Chair |

Professional Experience:

Mr. McClanathan served as President and Chief Executive Officer of the Household Products Division of Energizer Holdings, Inc., a manufacturer of portable power solutions, from 2007 through his retirement in 2012. Previously, he served Energizer as President and Chief Executive Officer of the Energizer Battery Division from 2004 to 2007, as President—North America from 2002 to 2004, and as Vice President—North America from 2000 to 2002.

Education:

Mr. McClanathan holds a degree in management from Arizona State University.

Public Company Boards:

Mr. McClanathan currently serves as a director of Brunswick Corporation, a market leader in the marine industry.

Director Qualifications:

Through his leadership experience at Energizer and as a former director of the Retail Industry Leaders Association, Mr. McClanathan offers an exceptional perspective to the Board on manufacturing operations, marketing and development of international capabilities.

| |

|

Judy C. Odom

| ||

|

Lead Independent Director

Director Since: 2002 Age: 69

Committees: HRC NGS

|

Professional Experience:

Until her retirement in 2002, Ms. Odom was Chief Executive Officer and Board Chair at Software Spectrum, Inc., a global business to business software services company, which she co-founded in 1983. Prior to founding Software Spectrum, she was a partner with the international accounting firm, Grant Thornton.

Education:

Ms. Odom is a licensed Certified Public Accountant and holds a degree in business administration from Texas Tech University.

Public Company Boards:

Ms. Odom previously served as a director of Sabre, Inc., a technology solutions provider for the global travel and tourism industry, and of Harte-Hanks, a direct marketing service company.

Director Qualifications:

Ms. Odom’s director experience with several companies offers a broad leadership perspective on strategic and operating issues. Her experience co-founding Software Spectrum and growing it to a global Fortune 1000 enterprise before selling it to another public company provides the insight of a long-serving CEO with international operating experience.

| |

|

16 |

2022 Proxy Statement |

Election of Directors

|

Srikanth Padmanabhan

| ||

|

Independent Director

Director Since: 2018 Age: 57

Committees: Audit NGS |

Professional Experience:

Mr. Padmanabhan has served Cummins Inc., a global manufacturer of engines and power solutions, as a Vice President since 2008 and President of its Engine Business segment since 2016. Previously, he served Cummins as Vice President—Engine Business from 2014 to 2016, Vice President and General Manager of Emission Solutions from 2008 to 2014, and in various other capacities since 1991.

Education:

Mr. Padmanabhan holds a bachelor’s degree in mechanical engineering from the National Institute of Technology in Trichy, India, a Ph.D. in mechanical engineering from Iowa State University, and has completed the Advanced Management Program at Harvard Business School.

Director Qualifications:

With over 30 years at Cummins in a variety of leadership roles, Mr. Padmanabhan offers considerable knowledge of the automotive industry and the industrial sector. He brings extensive experience in managing operations, technology and innovation across a multi-billion-dollar global business. He has lived and worked in India, the United States, Mexico, and the United Kingdom.

| |

|

Jai Shah

| ||

|

Independent Director

Director Since: 2019 Age: 55

Committees: Audit HRC |

Professional Experience:

Mr. Shah serves as a Group President of Masco Corporation, a Fortune 500 global leader in the design, manufacture and distribution of branded home improvement and building products. In this position since 2018, Mr. Shah has responsibility for operating companies with leading brands in architectural coatings, decorative and outdoor lighting, decorative hardware and wellness businesses in North America. Mr. Shah is also responsible for Masco’s Corporate Strategic Planning activities. He previously served as President of Delta Faucet Company, a Masco business unit, from 2014 to 2018, as Vice President and Chief Human Resources Officer for Masco from 2012 to 2014, and in various capacities since 2003. Prior to Masco, Mr. Shah held a number of senior management positions at Diversey Corporation and served as Senior Auditor for KPMG Peat Marwick Chartered Accountants.

Education:

Mr. Shah is a Certified Public Accountant and Chartered Professional Accountant (Canada) and holds an MBA from the University of Michigan, as well as bachelor’s and master’s degrees in accounting from the University of Waterloo in Ontario, Canada.

Director Qualifications:

Mr. Shah’s range of experience at Masco in a variety of operational, financial and corporate roles offers the Board a broad perspective on relevant issues facing global corporations, including growth strategy development and implementation, talent management, and adapting to e-business and market innovations.

| |

|

17 |

Election of Directors

|

Phoebe A. Wood

| ||

|

Independent Director

Director Since: 2005 Age: 68

Committees: Audit, Chair NGS |

Professional Experience:

Ms. Wood has been a principal in CompaniesWood, a consulting firm specializing in early stage investments, since her 2008 retirement as Vice Chairman and Chief Financial Officer of Brown-Forman Corporation, a diversified consumer products manufacturer, where she had served since 2001. Ms. Wood previously held various positions at Atlantic Richfield Company, an oil and gas company, from 1976 to 2000.

Education:

Ms. Wood holds a degree in psychology from Smith College and an MBA from UCLA.

Public Company Boards:

Ms. Wood is a director of Invesco, Ltd., an independent global investment manager, Pioneer Natural Resources, an independent oil and gas company, and PPL Corporation, a utility and energy services company.

Director Qualifications:

From her career in business and various directorships, Ms. Wood provides the Board with a wealth of understanding of the strategic, financial and accounting issues the Board addresses in its oversight role.

| |

The Board recommends that you vote FOR the election of each of the director nominees.

|

18 |

2022 Proxy Statement |

Audit Related Matters

PROPOSAL TWO: Ratification of Independent Registered Public Accounting Firm

The Audit Committee is directly responsible for the appointment of the Company’s independent registered public accounting firm and has selected PricewaterhouseCoopers LLP (“PwC”) for the fiscal year ending December 31, 2022. PwC has been our independent registered public accounting firm continuously since 1991.

The Audit Committee regularly evaluates activities to assure continuing auditor independence, including whether there should be a regular rotation of the independent registered public accounting firm. As with all matters, the members of the Audit Committee and the Board perform assessments in the best interests of the Company and our investors and believe that the continued retention of PwC meets this standard.

Although shareholder ratification of the Audit Committee’s selection of PwC is not required by the Company’s bylaws or otherwise, the Board is requesting ratification as a matter of good corporate practice. If our shareholders fail to ratify the selection, it will be considered a direction to the Audit Committee to consider a different firm. Even if this selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change is in the best interest of the Company and our shareholders.

PwC representatives are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate shareholder questions.

The Board recommends that you vote FOR the ratification of PwC

as the independent registered public accounting firm.

The Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of the independent external audit firm, directly involved in the selection of the lead engagement partner, and responsible for the audit fee negotiations associated with retaining PwC. The fees billed or expected to be billed by PwC for professional services rendered in fiscal years 2021 and 2020 are shown below.

|

Type of Service |

2021 | 2020 | ||||||

| Audit Fees(1) |

$ | 2,461,270 | $ | 2,396,996 | ||||

| Audit-Related Fees(2) |

22,768 | 132,970 | ||||||

| Tax Fees(3) |

811,850 | 231,406 | ||||||

| All Other Fees(4) |

9,196 | 14,075 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 3,305,084 | $ | 2,775,447 | ||||

| (1) | Includes rendering an opinion on the Company’s consolidated financial statements and the effectiveness of internal control over financial reporting; quarterly reviews of the Company’s financial statements; statutory audits, where appropriate; comfort and debt covenant letters; and services in connection with regulatory filings. |

| (2) | Includes assessment of controls; consulting on accounting and financial reporting issues; and audits of employee benefit plans. |

| (3) | Includes preparation and review of tax returns and tax filings; tax consulting and advice related to compliance with tax laws; tax planning strategies; and tax due diligence related to acquisitions and joint ventures. Of the tax fees listed above in 2021, $254,535 relates to compliance services and $557,315 relates to consulting and planning services. |

| (4) | Includes use of an international tax reporting software and an internet-based accounting research tool. |

|

19 |

Audit Related Matters

Pre-Approval Procedures for Audit and Non-Audit Services

The Audit Committee has established a procedure for pre-approving the services performed by the Company’s auditors. All services provided by PwC in 2021 were approved in accordance with the adopted procedures. There were no services provided or fees paid in 2021 for which the pre-approval requirement was waived.

The procedure provides standing pre-approval for:

Audit Services: quarterly reviews of the Company’s financial statements; statutory audits, where appropriate; comfort and debt covenant letters; consents and assistance in responding to SEC comment letters; and services in connection with regulatory filings.

Audit-Related Services: consultation on new or proposed transactions, statutory requirements, or accounting principles; reports related to contracts, agreements, arbitration, or government filings; continuing professional education; financial statement audits of employee benefit plans; and due diligence and audits related to acquisitions and joint ventures.

Tax Services: preparation or review of Company and related entity income, sales, payroll, property, and other tax returns and tax filings and permissible tax audit assistance; preparation or review of expatriate and similar employee tax returns and tax filings; tax consulting and advice related to compliance with applicable tax laws; tax planning strategies and implementation; and tax due diligence related to acquisitions and joint ventures.

Any other audit, audit-related, or tax services provided by the Company’s auditors require specific Audit Committee pre-approval. The procedure requires the Audit Committee to specifically pre-approve the terms of the annual audit services engagement letter with the Company’s auditor, including all audit procedures required to render an opinion on the Company’s annual financial statements and on the effectiveness of the Company’s internal control over financial reporting. The Audit Committee must also specifically approve, if necessary, any changes in terms of the annual audit engagement resulting from changes in audit scope, Company structure or other matters. The Audit Committee must also specifically approve in advance all other permissible Non-Audit Services to be performed by the Company’s auditors.

Management provides quarterly reports to the Audit Committee regarding the nature and scope of any non-audit services performed and any fees paid to the auditors for all services. The Audit Committee has determined that the provision of the approved Non-Audit Services by PwC in 2021 is compatible with maintaining PwC’s independence.

The current Audit Committee is composed of six non-management directors who are independent as required by SEC and NYSE rules. The Audit Committee operates under a written charter adopted by the Board which is posted on the Company’s website at www.leggett.com/governance.

Management is responsible for the Company’s financial statements and financial reporting process, including the system of internal controls. PwC, our independent registered public accounting firm, is responsible for expressing an opinion on the conformity of the audited consolidated financial statements with accounting principles generally accepted in the United States.

The Audit Committee is responsible for monitoring, overseeing and evaluating these processes, providing recommendations to the Board regarding the independence of and risk assessment procedures used by our independent registered public accounting firm, selecting and retaining our independent registered public accounting firm, and overseeing compliance with various laws and regulations.

At its meetings, the Audit Committee reviewed and discussed the Company’s audited financial statements with management and PwC. The Audit Committee also discussed with PwC all items required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the SEC.

|

20 |

2022 Proxy Statement |

Audit Related Matters

The Audit Committee received the written disclosures and letter from PwC required by applicable requirements of the PCAOB regarding PwC’s communications with the Audit Committee concerning independence and has discussed PwC’s independence with them.

The Audit Committee has relied on management’s representation that the financial statements have been prepared in conformity with accounting principles generally accepted in the United States and on the opinion of PwC included in their report on the Company’s financial statements.

Based on review and discussions with management and PwC referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s 2021 Annual Report on Form 10-K.

| Phoebe A. Wood (Chair) | Robert E. Brunner | Srikanth Padmanabhan | ||||||

| Mark A. Blinn | Mary Campbell | Jai Shah |

|

21 |

Say on Pay

PROPOSAL THREE: Advisory Vote to Approve Named Executive Officer Compensation

Pursuant to Section 14A of the Securities Exchange Act of 1934, Leggett’s shareholders have the opportunity to vote on an advisory resolution, commonly known as “Say-on-Pay,” to approve the compensation of Leggett’s Named Executive Officers (NEOs), as described in the Executive Compensation and Related Matters section beginning on page 23.

Since Say-on-Pay was implemented in 2011, our shareholders have supported the compensation of our NEOs with over 90% of the vote (with 95% support in 2021). Our Board has adopted a policy providing for an annual Say-on-Pay vote.

Our Human Resources and Compensation Committee is committed to creating an executive compensation program that enables us to attract and retain a superior management team that has targeted incentives to build long-term value for our shareholders. The Company’s compensation package uses a mix of cash and equity-based awards to align executive compensation with our annual and long-term performance. These programs reflect the Committee’s philosophy that executive compensation should provide greater rewards for superior performance, as well as accountability for underperformance. At the same time, we believe our programs do not encourage excessive risk-taking by management. The Board believes that our philosophy and practices have resulted in executive compensation decisions that are appropriate and that have benefited the Company over time.

For these reasons, the Board requests our shareholders approve the compensation paid to the Company’s NEOs as described in this proxy statement, including the Compensation Discussion and Analysis, the executive compensation tables and the related footnotes and narrative accompanying the tables.

Because your vote is advisory, it will not be binding upon the Board; however, the HRC Committee and the Board have considered and will continue to consider the outcome of the vote when making decisions for future executive compensation arrangements.

The Board recommends that you vote FOR the Company’s Named Executive Officer compensation package.

Discretionary Vote on Other Matters

We are not aware of any business to be acted upon at the Annual Meeting other than the three items described in this proxy statement. Your signed proxy, however, will entitle the persons named as proxy holders to vote in their discretion if another matter is properly presented at the meeting. If one of the director nominees is not available as a candidate for director, the proxy holders will vote your proxy for such other candidate as the Board may nominate.

|

22 |

2022 Proxy Statement |

Executive Compensation and Related Matters

Compensation Discussion & Analysis

Our Human Resources and Compensation Committee, currently consisting solely of independent directors, is committed to creating and overseeing an executive compensation program that enables Leggett & Platt to attract and retain a superior management team that has targeted incentives to build long-term value for our shareholders. To meet these objectives, the Committee has implemented a compensation package that:

| • | Emphasizes performance-based equity programs. |

| • | Sets incentive compensation targets intended to drive performance and shareholder value. |

| • | Balances rewards between short-term and long-term performance to foster sustained excellence. |

| • | Motivates our executive officers to take appropriate business risks. |

This Compensation Discussion and Analysis describes our executive compensation program and the decisions affecting the compensation of our Named Executive Officers (NEOs):

| Name |

Title | |

| Karl G. Glassman |

Chairman and Chief Executive Officer through December 31, 2021 (former CEO) and current Executive Chairman | |

| J. Mitchell Dolloff |

President and Chief Executive Officer as of January 1, 2022 (current CEO), and President and Chief Operating Officer (COO) through December 31, 2021 | |

| Jeffrey L. Tate |

Executive Vice President and Chief Financial Officer (CFO) | |

| Steven K. Henderson |

Executive Vice President (EVP), President—Specialized Products and Furniture, Flooring & Textile (FF&T) Products | |

| Scott S. Douglas |

Senior Vice President (SVP)—General Counsel and Secretary | |

Executive Summary

This section provides an overview of our NEOs’ compensation structure, Leggett’s pay practices, and the Committee’s compensation risk management. Additional details regarding the NEOs’ pay packages, the Committee’s annual review of the executive officers’ compensation, and our equity pay practices are covered in the sections that follow.

|

23 |

Compensation Discussion & Analysis

Structuring the Mix of Compensation

The Committee uses its judgment to determine the appropriate percentage of fixed and variable compensation, the use of short-term and long-term performance periods, and the split between cash and equity-based compensation. The final payment and value of the variable elements depends on actual performance and could result in no payout if threshold performance levels are not achieved. The following table shows the key attributes of our 2021 executive compensation structure used to drive performance and build long-term shareholder value.

|

Compensation Type |

Fixed or |

Cash or Equity-Based |

Term |

Basis for Payment | ||||

| Base Salary |

Fixed |

Cash |

1 year |

Individual responsibilities, performance and experience with reference to external benchmarking | ||||

| Annual Incentive |

Variable |

Cash |

1 year |

Return on capital employed (60% weighting) and cash flow (40% weighting) | ||||

| Long-Term Incentive – two-thirds allocated to Performance Stock Units |

Variable |

Equity- |

3 years |